Why Every Industry Needs Different Google Ads Strategies

A law firm and a bakery both contacted me last month asking why their campaigns weren’t working. When I reviewed their accounts, they’d made the same fundamental mistake—using generic one-size-fits-all strategies that ignored their completely different business models, customer behaviors, and sales cycles. The lawyer was treating legal consultations like impulse purchases. The bakery was using B2B targeting for B2C customers. Both were burning money because they didn’t understand that successful advertising requires industry-specific approaches.

This happens constantly. Businesses copy strategies that worked for completely different industries, then wonder why results don’t materialize. What works brilliantly for ecommerce fails miserably for professional services. B2B tactics that generate quality leads fall flat for local businesses.

The Industry Reality Nobody Explains

Here’s what most businesses don’t understand: Google Ads performance varies dramatically across industries because customer behavior, purchase decisions, and sales processes are fundamentally different. Average conversion rates range from 2.23% in technology to 9.64% in auto services—a 432% variation. Cost per click varies even more wildly, from ₹20 in education to over ₹800 in legal services.

These differences aren’t random—they reflect underlying business realities that demand strategic adjustments. A ₹500 consumer product with 10-second purchase decisions requires completely different advertising than a ₹50 lakh industrial equipment purchase involving six-month evaluation cycles and multiple decision makers. The targeting, messaging, bidding strategies, landing pages, and conversion tracking must align with how customers actually buy in your specific industry.

B2B businesses face unique challenges that B2C strategies can’t address. Buying cycles stretch 6-18 months involving multiple stakeholders—procurement teams, technical evaluators, financial approvers, and end users. The person clicking ads rarely makes final purchase decisions, so tracking needs to capture multi-step journeys through content downloads, demo requests, and sales conversations. Cost per lead might exceed ₹10,000, but customer lifetime values justify those acquisition costs.

B2C businesses operate in completely different reality. Purchase decisions happen quickly—often within minutes of first exposure. Emotional triggers drive conversions more than logical evaluation. Transaction values are typically lower but volume compensates through repeat purchases. The advertising approach must capture attention immediately and push prospects toward instant action rather than nurturing long consideration processes.

Service businesses present another distinct challenge set. Local plumbers, electricians, lawyers, and consultants need geographic targeting precision ensuring ads only reach people within service areas. High-intent keywords dominate because service purchases happen when problems arise—”emergency plumber near me” converts infinitely better than generic “plumbing services”. Call tracking becomes critical since most conversions happen through phone calls rather than form submissions.

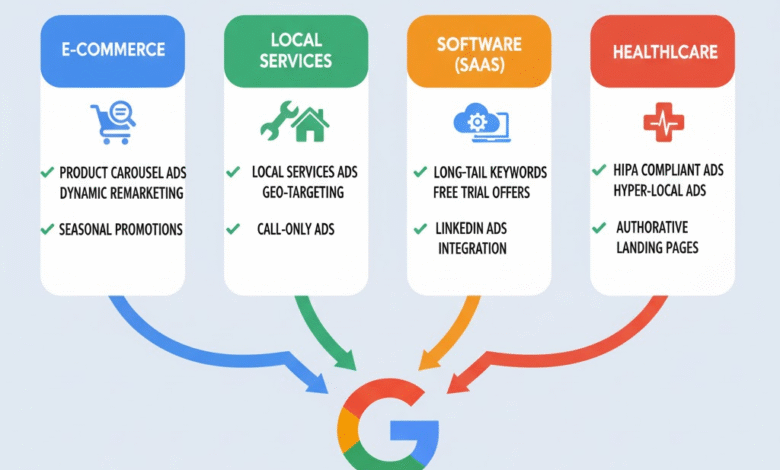

Ecommerce requires product-focused strategies completely different from lead generation. Shopping campaigns showcasing product images, prices, and specifications directly in search results drive most qualified traffic. Dynamic remarketing follows browsers around showing exact products they viewed. Transaction value tracking enables revenue optimization rather than just conversion counting. Abandoned cart targeting recovers sales from people who loaded carts but didn’t complete purchases.

The Strategic Adjustments Each Industry Requires

This is where professional adwords management services provide tremendous value through industry-specific expertise businesses can’t develop internally. Agencies working across multiple industries understand the strategic variations required for different business models. They don’t apply generic templates—they customize campaigns around how customers actually behave in specific sectors.

For B2B industrial companies, keyword strategies focus on technical specifications and problem-solving terms that engineers and procurement professionals actually search. “Custom CNC machining titanium parts” attracts manufacturers seeking specific capabilities, while generic “machining services” wastes budget on hobby machinists and students. The landing pages address technical requirements, certifications, case studies, and specifications that committee decision-making demands.

The bidding approaches differ too. B2B campaigns use Target CPA optimized for qualified leads rather than raw conversion volume. A manufacturing company generating 100 junk leads at ₹500 each fails compared to 10 qualified leads at ₹5,000 each if those 10 close at 50% and generate ₹10 lakh average orders. The economics justify higher acquisition costs when customer values are substantial.

Local service businesses require completely different strategic foundations. Location targeting sets tight radiuses ensuring ads only reach people within service areas—a plumber serving South Bangalore shouldn’t pay for clicks from North Bangalore residents 30 kilometers away. The “presence” setting rather than “presence or interest” prevents wasting budget on tourists researching local services before trips.

Local Services Ads change the game for eligible businesses offering plumbing, electrical, HVAC, locksmith, and similar services. These pay-per-lead placements at the very top of search results with Google Guarantee badges establish immediate credibility. You only pay when someone actually calls or messages—no wasted clicks from browsers who never intended to hire anyone. The vetting process creates barriers competitors can’t easily replicate.

Ecommerce campaigns leverage Google Shopping as the primary traffic driver. Product feeds containing titles, descriptions, images, prices, and availability information power ads that appear directly in search results. Feed optimization becomes critical—poorly written titles, missing attributes, or quality issues prevent products from showing or ranking competitively. Dynamic remarketing follows browsers showing exact products viewed on your site as they browse elsewhere.

The Seasonal and Cycle Variations That Demand Adjustments

Beyond baseline industry differences, seasonal patterns and business cycles require strategic adaptations most businesses ignore. Retail peaks during holidays demand ramping budgets 3-5x normal levels to capture elevated demand. Tax services concentrate advertising January through April when most people actually need accountants. Wedding photographers focus spring through fall when ceremonies happen.

B2B seasonal patterns look different but matter equally. Many industries have fiscal year-end buying surges as companies spend remaining budgets. Software purchases concentrate Q4 for January implementations. Manufacturing slows during summer plant shutdowns and winter holidays. Strategic budget allocation shifts dramatically across these cycles rather than maintaining constant spending year-round.

Professional management handles these fluctuations systematically rather than reactively. Historical data reveals exactly when your specific business sees demand spikes. Budget planning happens months ahead, ramping spending before peak periods begin rather than reacting after they arrive. The messaging adjusts seasonally—tax services emphasize refund maximization in February, deadline urgency in April.

Competitive dynamics shift seasonally too. CPCs spike 40-80% during high-demand periods as competition intensifies. Businesses with strategic seasonal planning scale early, establishing presence before prices escalate. Those reacting late pay premium rates for reduced inventory, limiting results despite higher spending.

Why Generic Management Fails Industry-Specific Needs

Professional google ads agency delivering industry-specific expertise transform campaign performance through strategic customization generic approaches miss entirely. Agencies specializing in or experienced with your sector understand the nuanced differences that separate success from failure.

They know which keywords indicate genuine purchase intent versus information gathering in your industry. They recognize the decision-making processes and buying committee dynamics that affect conversion paths. They understand typical sales cycle lengths determining appropriate attribution windows and conversion tracking methodologies. They’ve optimized landing pages specifically for your industry’s prospects, speaking their language and addressing their concerns.

The competitive intelligence becomes industry-specific too. What competitors do in your sector matters far more than general PPC trends. Agencies analyze competitive positioning within your industry—which keywords competitors dominate, where gaps exist, what messaging differentiates leaders from followers. This intelligence informs strategic positioning that captures valuable market share competitors leave exposed.

Technology selection matches industry needs precisely. B2B companies benefit enormously from CRM integration feeding closed-won data back to optimize toward revenue rather than just leads. Ecommerce businesses need shopping feed management tools and dynamic remarketing platforms. Service businesses require call tracking and lead scoring systems. Generic management using one-size-fits-all technology stacks misses critical capabilities your industry demands.

The conversion tracking infrastructure gets configured for industry-specific customer journeys. B2B tracks micro-conversions through content downloads and demo requests before final sales close months later. Ecommerce measures transaction values, average order values, and customer lifetime value. Service businesses track phone calls, form submissions, and booking completions through different paths. Each industry requires custom measurement frameworks capturing what actually drives business value.

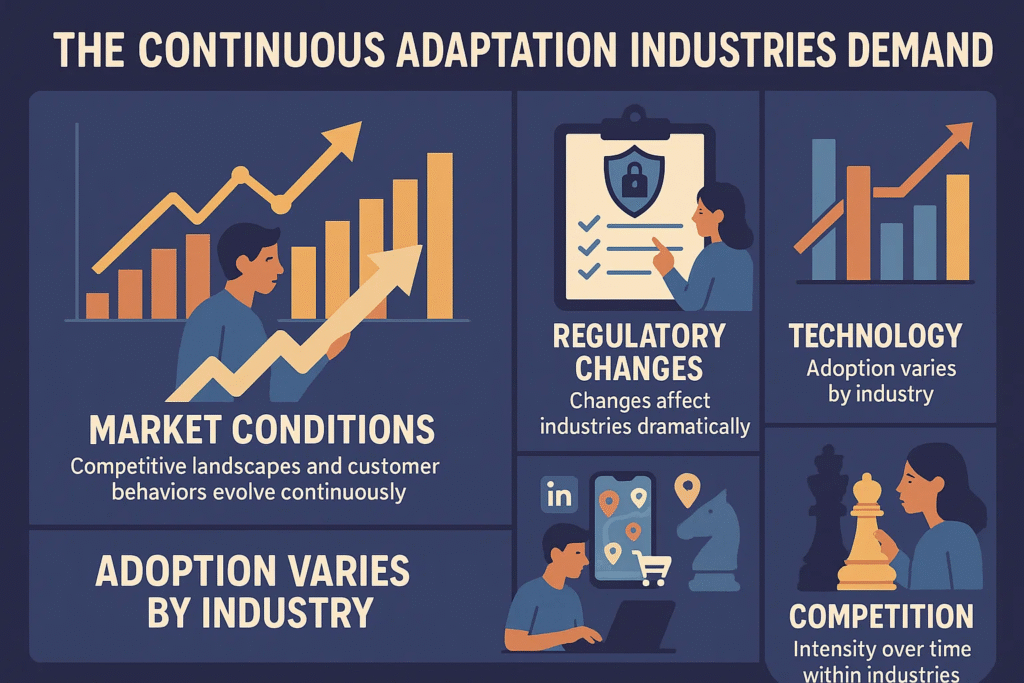

The Continuous Adaptation Industries Demand

Market conditions, competitive landscapes, and customer behaviors evolve continuously within every industry. Successful campaigns adapt to these changes rather than running static strategies indefinitely. Professional management maintains industry awareness identifying shifts requiring strategic adjustments.

Regulatory changes affect certain industries dramatically. Healthcare advertising faces HIPAA compliance requirements limiting what can be said and tracked. Financial services must navigate securities regulations and advertising restrictions. Legal services in many regions prohibit certain claims and testimonials. Staying compliant while maximizing effectiveness demands specialized industry knowledge.

Technology adoption varies by industry too. B2B audiences increasingly use LinkedIn for research, making LinkedIn Ads coordination with Facebook advertising and Google campaigns essential. Local services see high mobile usage with “near me” searches dominating, requiring mobile-first strategies. Ecommerce customers use multiple devices before purchasing, demanding cross-device tracking and attribution.

The competitive intensity shifts over time within industries. New entrants change bidding dynamics, forcing strategic repositioning. Category leaders increase spending, requiring nimble smaller competitors to find positioning gaps. Market consolidation through acquisitions changes the entire competitive landscape overnight. Professional management monitors these shifts, adjusting strategies before market changes undermine performance.

The Industry Expertise That Multiplies Results

Campaign success requires understanding your industry’s unique characteristics, customer behaviors, competitive dynamics, and seasonal patterns. Generic strategies ignoring these industry-specific realities waste budgets fighting fundamental mismatches between tactics and business models.

Working with services providing industry-specific expertise eliminates this strategic gap through knowledge businesses can’t develop internally without years focused on advertising. You get customized approaches matching how customers actually buy in your sector. You benefit from competitive intelligence revealing opportunities within your specific market. You receive continuous strategic adaptation as industry conditions evolve.

The alternative is applying generic tactics that worked for completely different business models, wondering why results don’t materialize despite following “best practices”. Smart businesses recognize that advertising effectiveness comes from industry-specific strategic alignment, not universal formulas applied everywhere identically. Professional expertise transforms campaigns from generic guessing into precision tools optimized for exactly how your industry operates.